Tackle New Markets Smartly

Plus, 🛍️Shop from Home or In-Store?

Hey Readers 🥰

Welcome to today's edition, bringing the latest growth stories fresh to your inbox.

If your pal sent this to you, then subscribe to be the savviest marketer in the room😉

The Obvi Guide to Global Growth

Insights from Chewonthis

Every high-growth brand faces a ceiling at some point. Whether due to competition, saturation, or internal challenges, the solution might lie beyond domestic borders. That’s what Obvi discovered when they ventured into international markets.

Why Go Global?

As Obvi’s growth in the competitive U.S. health supplements market began to slow, the team realized the potential overseas. With less competition and a growing health and wellness trend, international expansion promised new opportunities. Regions like Europe and Australia presented large, untapped markets with less crowded spaces for digital-first brands.

Key Challenges

However, going global isn’t without its hurdles. Managing logistics across continents, navigating tax regulations, and localizing content for diverse audiences presented significant challenges. Obvi tackled these by partnering with international consultants, refining their supply chain, and adopting a phased rollout approach to gauge interest in new markets before fully committing.

The Takeaway

Obvi learned the importance of patience and expert partnerships in scaling internationally. Their success overseas not only unlocked new revenue streams but also reinforced their U.S. operations. The brand is now poised to explore markets in Asia and Latin America, proving that thoughtful, strategic expansion can reignite growth for even the most saturated brands.

E-Commerce vs. Offline: The Changing Landscape

Insights from Stacked Marketer

As the digital world continues to expand, e-commerce is undeniably gaining ground on traditional brick-and-mortar stores. Though offline shopping still dominates, online sales are steadily increasing their share of the market. Here’s a closer look at the shift:

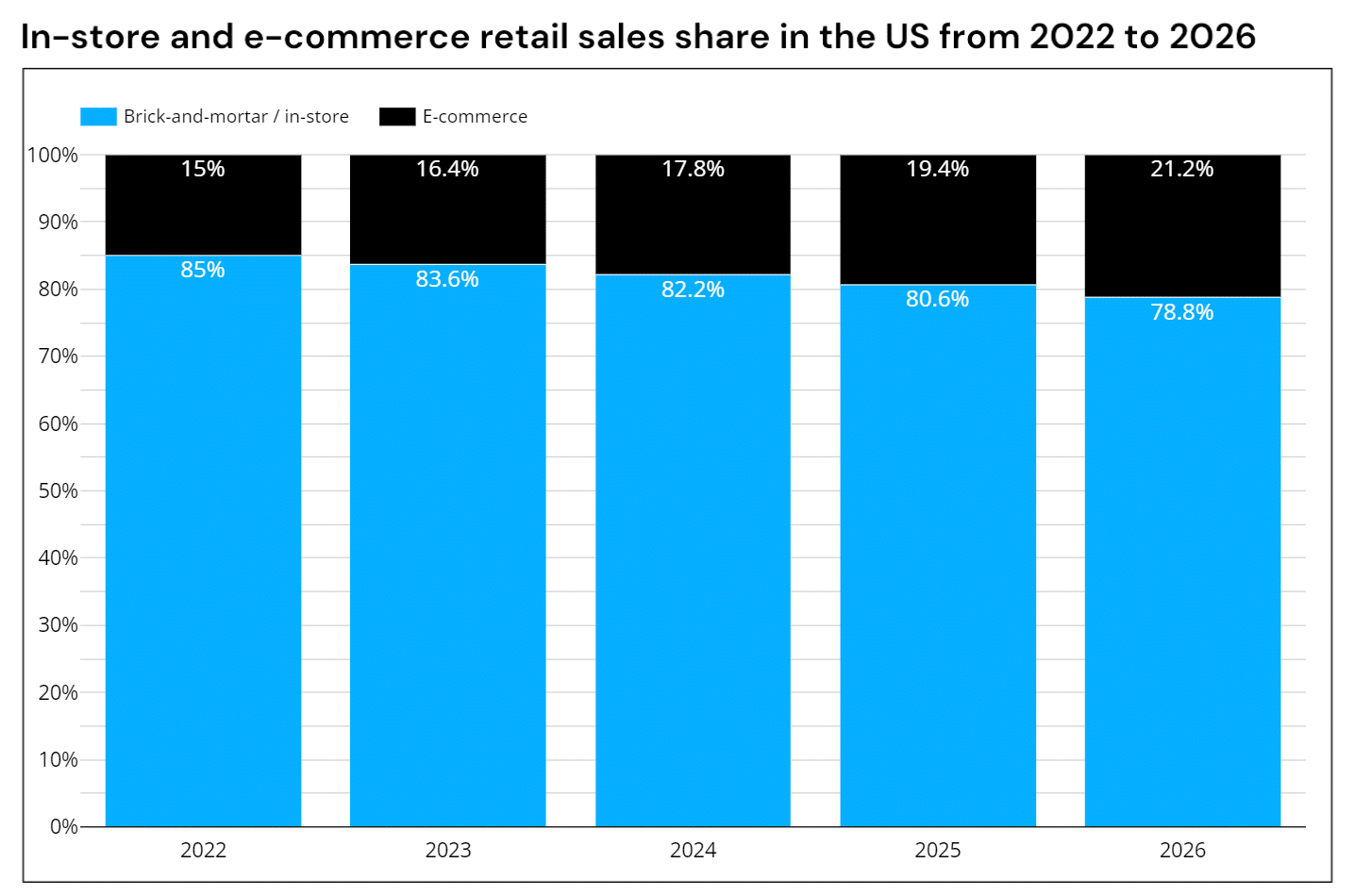

E-Commerce Is Growing—But Slowly

While brick-and-mortar stores maintain a stronghold, e-commerce is creeping up. By 2026, it’s predicted that online sales will make up over 20% of total U.S. retail sales. The global market is expected to grow from $5.8T in 2022 to $9.4T by 2026, showing steady, if not explosive, growth.

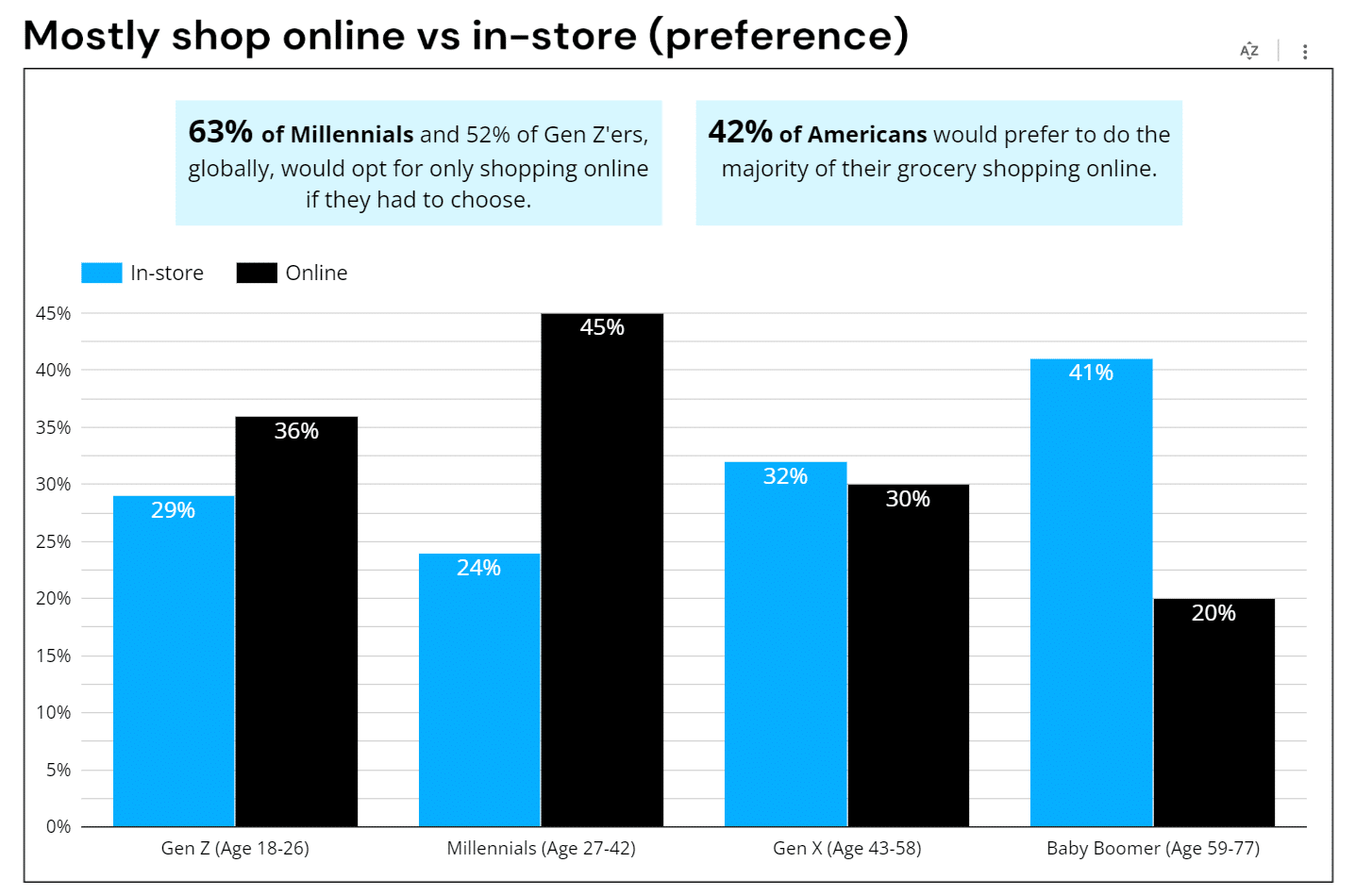

Generational Differences in Shopping Preferences

Younger generations, particularly millennials, overwhelmingly prefer online shopping, with 45% opting for digital over physical stores. Older generations, however, still lean toward offline shopping, with baby boomers choosing in-store purchases 41% of the time.

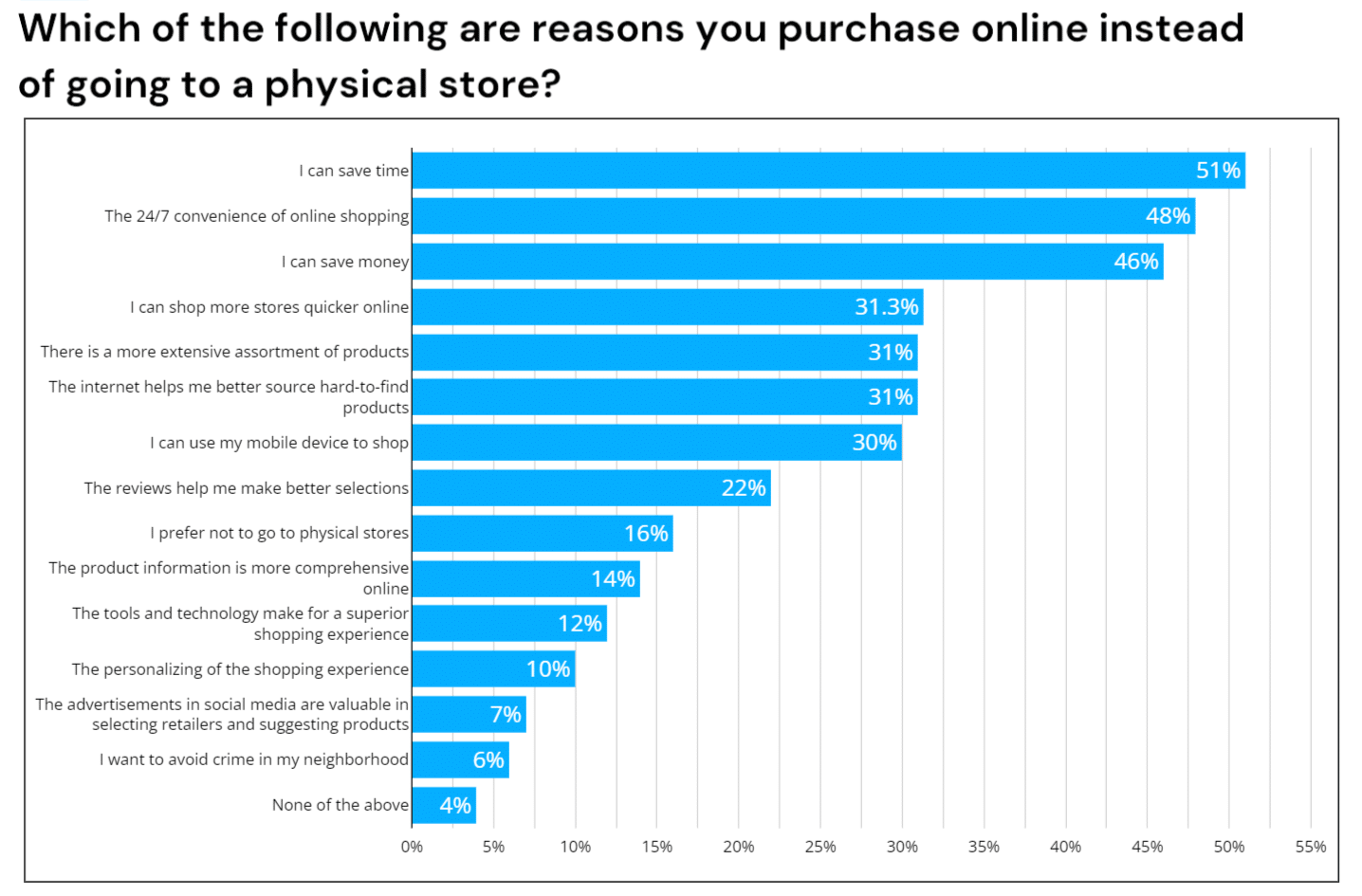

Why Consumers Choose Online

Beyond convenience, shoppers love the ability to find hard-to-get products, save money, and shop at any hour. Optimizing for mobile and making customer reviews easily accessible can further boost online appeal.

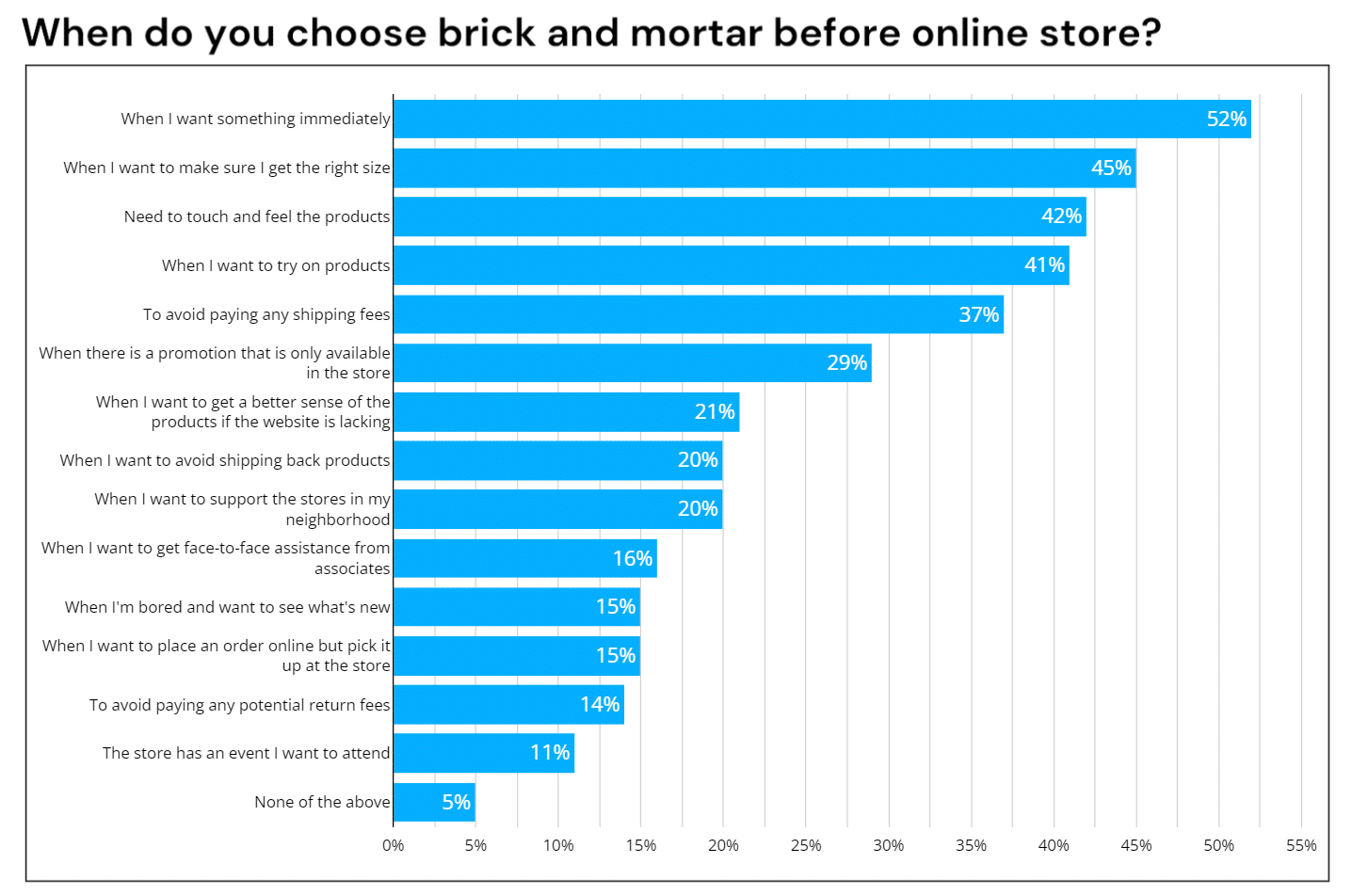

Offline’s Strengths

In-store shopping excels for immediate needs and tactile experiences—52% of shoppers value physical stores for items they need quickly. However, online businesses can close the gap by offering free shipping, detailed descriptions, and augmented reality tools.

The Takeaway

E-commerce and offline shopping will coexist for the foreseeable future. Brands should focus on leveraging the strengths of both to serve an increasingly hybrid shopping experience.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format.

Have a great day, and we'll be back again with more such content 😍