Growth Strategies Built on Overlooked Users

Plus, 💰What Drives Your Business Worth?

Hey Readers 🥰

Welcome to today's edition, bringing the latest growth stories fresh to your inbox.

If your pal sent this to you, then subscribe to be the savviest marketer in the room😉

🚀 Unlocking Growth with Adjacent User Theory

Insights from Demand Curve

Too often, product teams focus solely on their most engaged users, leaving potential adjacent audiences untapped. By identifying and catering to these near-miss users, you can expand your product’s reach and unlock new growth opportunities.

What Is the Adjacent User Theory?

Core Users: These are the customers for whom your product was designed. They understand its value and engage with minimal friction.

Adjacent Users: These are individuals who could benefit from your product but encounter barriers like unclear messaging, feature gaps, or onboarding difficulties. They might need slight modifications to fully adopt your product.

1️⃣ Recognize the Overlooked

Teams often create products for power users—those familiar with the tool’s intricacies. Adjacent users, however, lack this insider knowledge and face hurdles in understanding how your product fits their needs.

Execution Tip: Analyze your user base to identify who’s interested but not converting. What’s stopping them? Simplify your messaging and remove barriers.

2️⃣ Learn from Successful Expansions

Examples abound of companies embracing adjacent users:

- LinkedIn: Started for job seekers but added features for freelancers and creators.

- Airbnb: Expanded from air mattress rentals to full home accommodations.

- Slack: Shifted from developers to include marketers and designers.

Execution Tip: Look for unexpected ways users already engage with your product and build on that behavior.

3️⃣ Incremental Expansion

Addressing adjacent users doesn’t mean alienating core users. Experiment with tweaks like simplified onboarding, clearer messaging, or added features.

Execution Tip: A/B test ads targeted at adjacent audiences, exploring what resonates while maintaining your core appeal.

The Takeaway

Your core audience is only part of the story. Growth lies in understanding and adapting to adjacent users. A little effort to address their needs can drive massive results.

💼 How Much Is Your Business Worth?

Insights from Stacked Marketer

Ever wondered what your online business might be worth? Understanding valuation trends can make all the difference when it comes to buying, selling, or scaling. Empire Flippers, a leading online business marketplace, reveals key insights into how businesses are valued in today’s market.

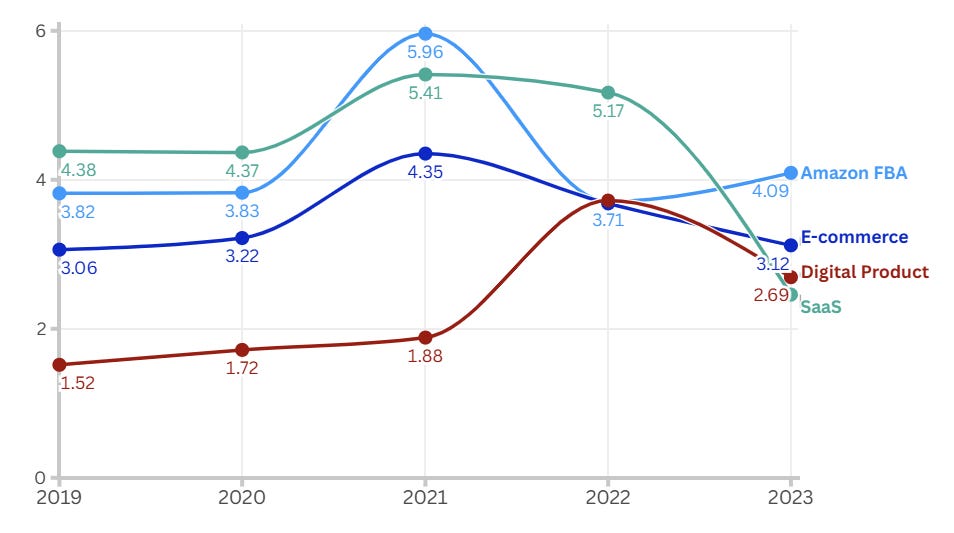

🔑 Profit Multiples: The Foundation of Valuation

Business value often hinges on profit multiples, calculated by dividing the sales price by yearly profit. For 2023, the average multiple was 4.3x. That means a business generating $100k in annual profit could fetch around $430k.

While multiples peaked during the pandemic due to increased online activity, they’ve since leveled out. Post-2023 trends suggest a buyer-friendly market, so sellers should temper expectations and focus on highlighting profitability.

Average yearly profit multiple by industry

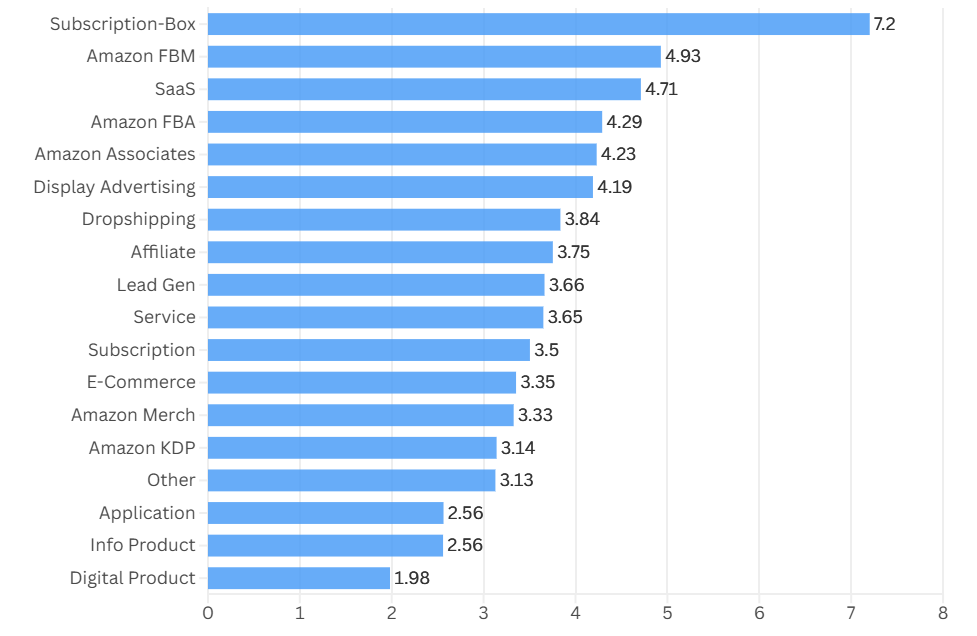

📊 Industry-Specific Trends

Not all industries are valued equally:

- Subscription Boxes: High profit multiples (up to 7x) thanks to predictable revenue streams.

- E-commerce: Lower margins but significant scalability, making it a top pick for buyers.

- Digital Products: Challenging to sell, especially when tied to personal brands.

Execution Tip: Prioritize customer retention and scalability to boost your valuation.

Average yearly profit multiple by industry

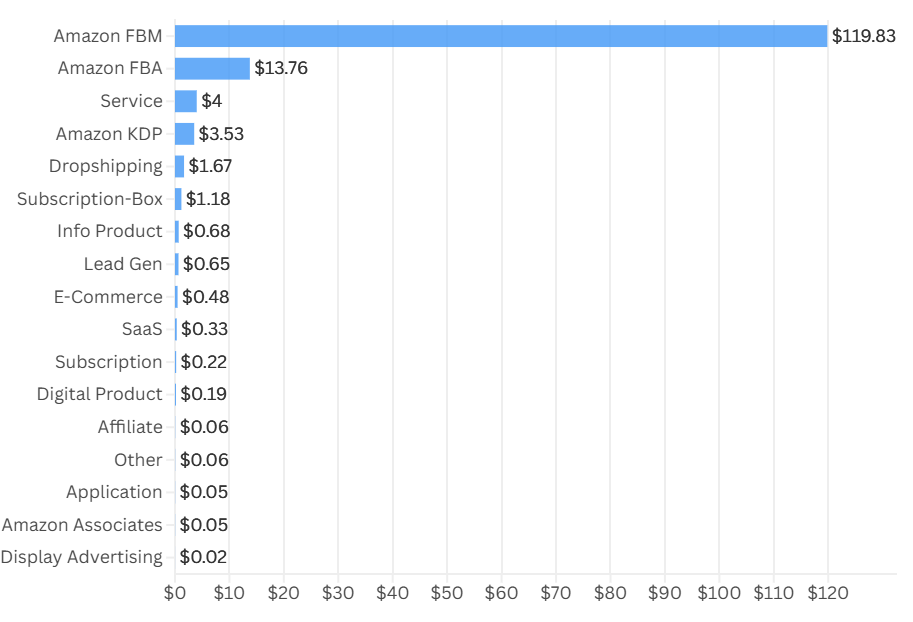

📈 Traffic and Its Impact

Traffic volume plays a significant role but isn’t the sole determinant. Content sites relying on display ads might need 100k monthly visitors to achieve a $4k valuation, whereas service businesses require less traffic to command similar prices.

Execution Tip: Focus on increasing high-quality traffic with strong buyer intent.

Average price per traffic per industry

The Takeaway

The online business market remains competitive, with profitability and scalability driving valuations. Whether you’re planning to sell or scale, understanding these trends ensures you position your business effectively. Platforms like Empire Flippers provide the tools to assess and maximize your business’s worth.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format.

Have a great day, and we'll be back again with more such content 😍